Key insights Into 2023 Technology Trends

Technology is one of the major driving forces of change across eCommerce and the media in today’s world. New possibilities are constantly opening up, creating opportunities for innovation and growth previously more difficult to achieve.

In the 2023 Activate Technology and Media Outlook report, Activate has completed a deep dive into customer segmentation and motivation across technology and media, with detailed analytics to provide valuable understanding of technology and media landscapes, now and in the future.

Current consumer segmentation analysis

The report discovered that the additional time users spent interacting with technology and media during the pandemic – about an hour extra per day – had largely stayed consistent post Covid-19.

Plus, this study predicts that 20% of US retail sales will derive from eCommerce by 2026, centred not only with larger eCommerce companies but also category-focused businesses, a trend likely to be reflected globally.

This statistic is complemented with the calculation that there will potentially be $400B in growth for the global internet and media industries between now and 2026.

One interesting data segment is related to the Super User, who represent 22% of the US population and spend double the amount of time consuming media in comparison to all other users.

A standout headline is that video dominates, capturing the largest share of consumer time spent daily on technology and media. US consumers will increase video intake to around 1 hour per day by 2026. But it’s thought that gaming will be the area to see the most significant increase of 2.7% by 2026.

7 tech and media channels creating potential

The Activate 2023 report zones in on 7 crucial areas worthy of attention from creative and tech companies looking to expand and grow during the next couple of years.

1. Video and social drive growth

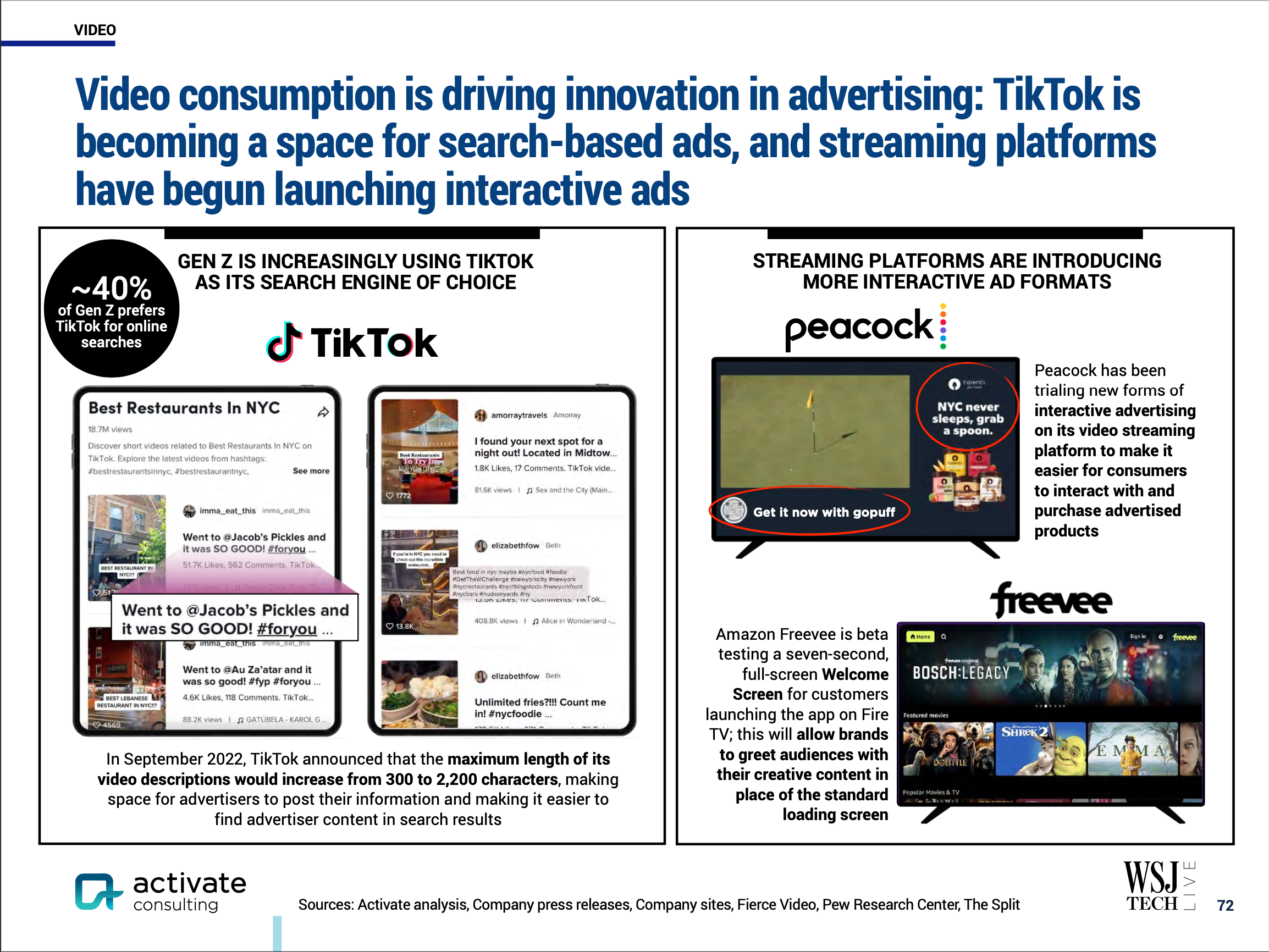

TikTok continues to become a prominent space for search-based ads and leads the way as influencers dominate social video engagement with 91% share of this sector.

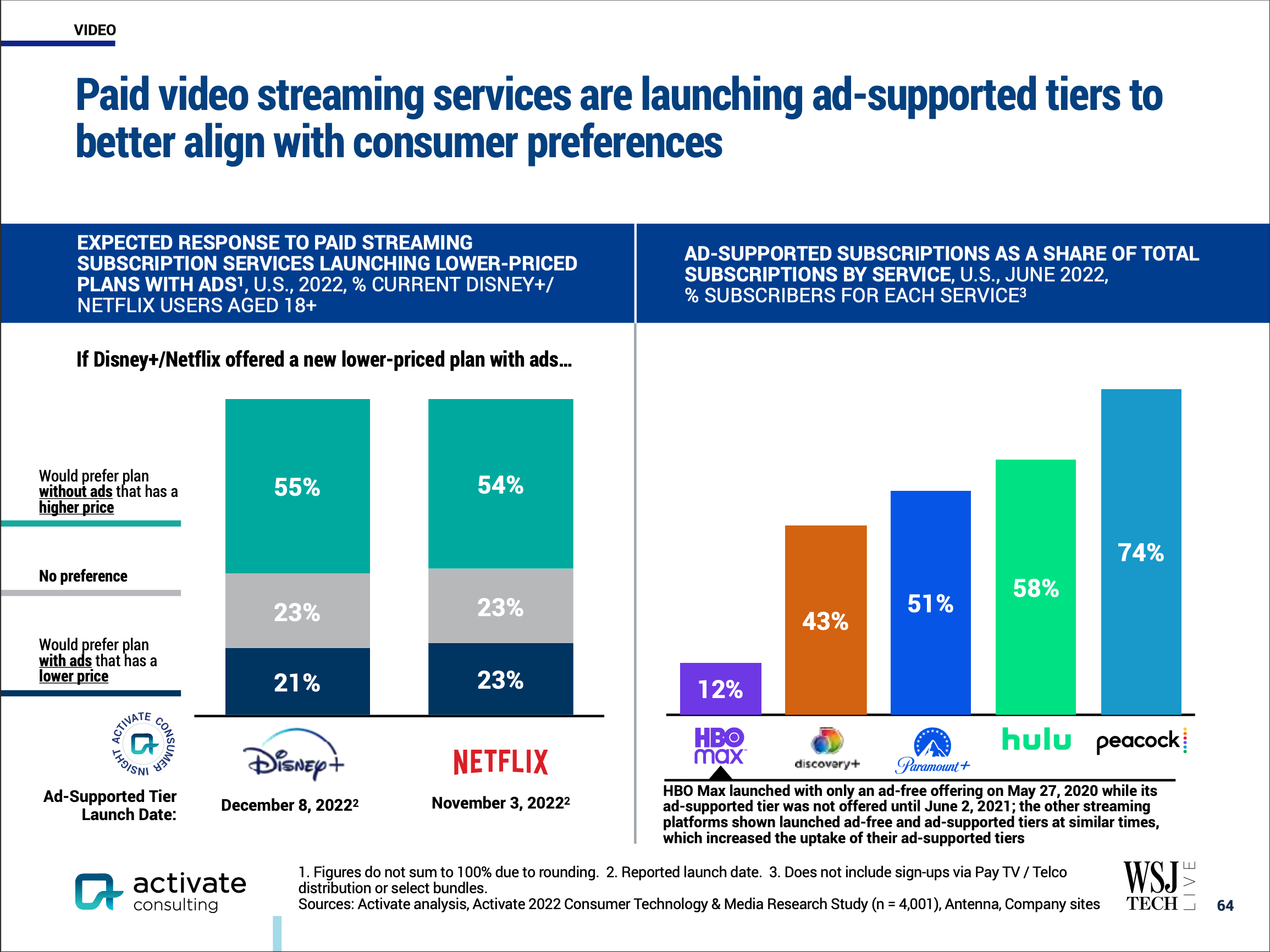

Within streaming services, streaming content spend on original series and movies is increasing to grow consumption even further. Many streaming services have raised prices to strengthen their position in the market, and as a result viewers are appreciating better value bundle packages.

An interesting point to note is that paid services are developing ad-supported tiers that are more in line with customer interests.

2. Gaming and esports

Gaming is performing strongly across the globe, with the international market set to grow to around $220B by 2026. Powerful contenders within the industry are leading by providing cross-platform, multiplayer and open world features to engage gamers with creative and connected experiences.

With over half a billion esports fans around the world, the development of this space seems to be focusing on media rights and distribution to attract more diverse audiences.

Just like the gaming industry, multiplicity is vital to exponential expansion over the next 3 years.

3. NFTs

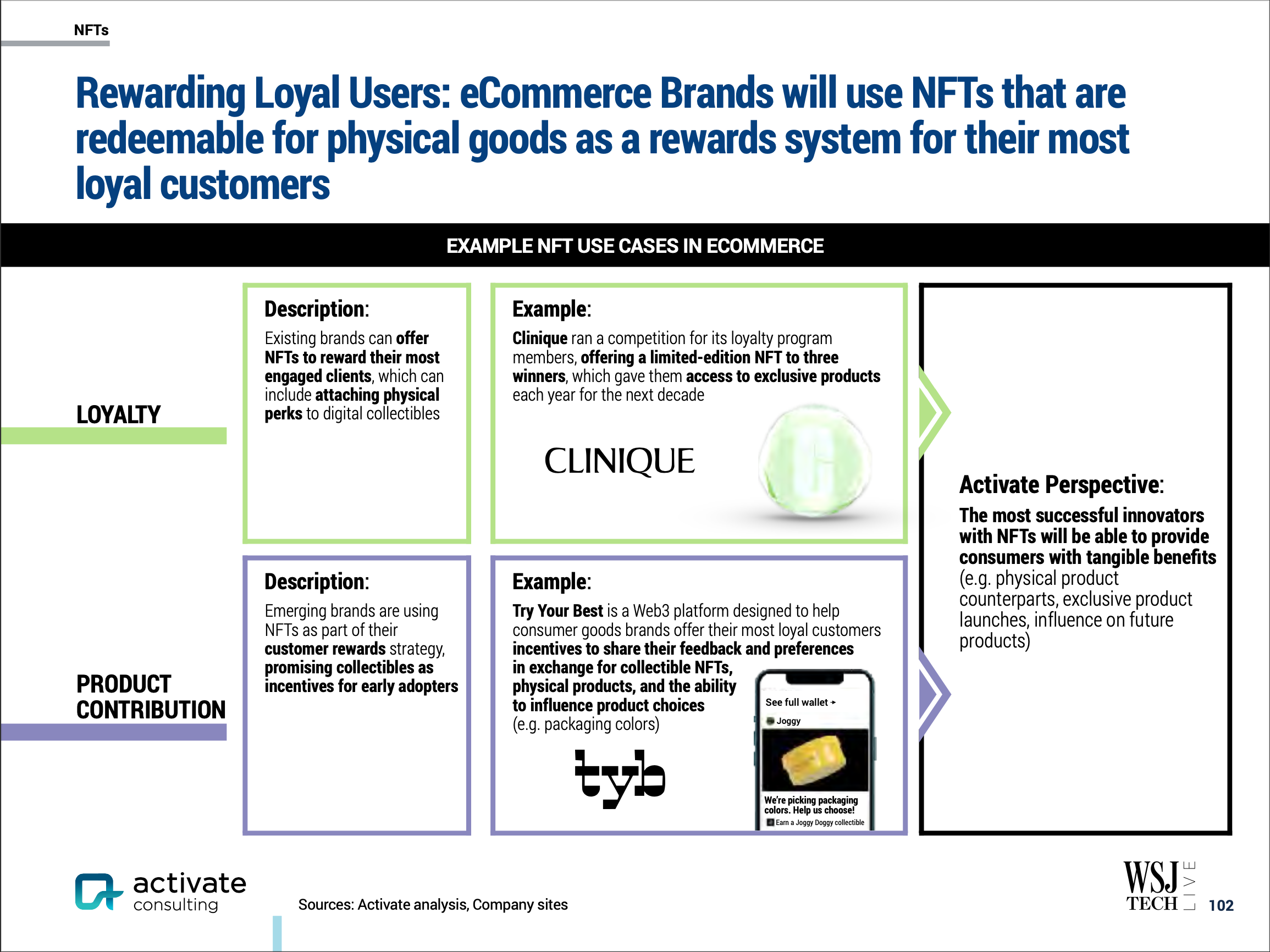

Perceptions and practical applications of NFTs are now becoming more common, with a distinctive shift to problem solving for communities and users developing digital collection and display standpoints.

With a greater proportion of young and affluent customers creating NFT strongholds, NFTs have the potential to generate tangible value with exclusive digital communities and loyalty reward schemes.

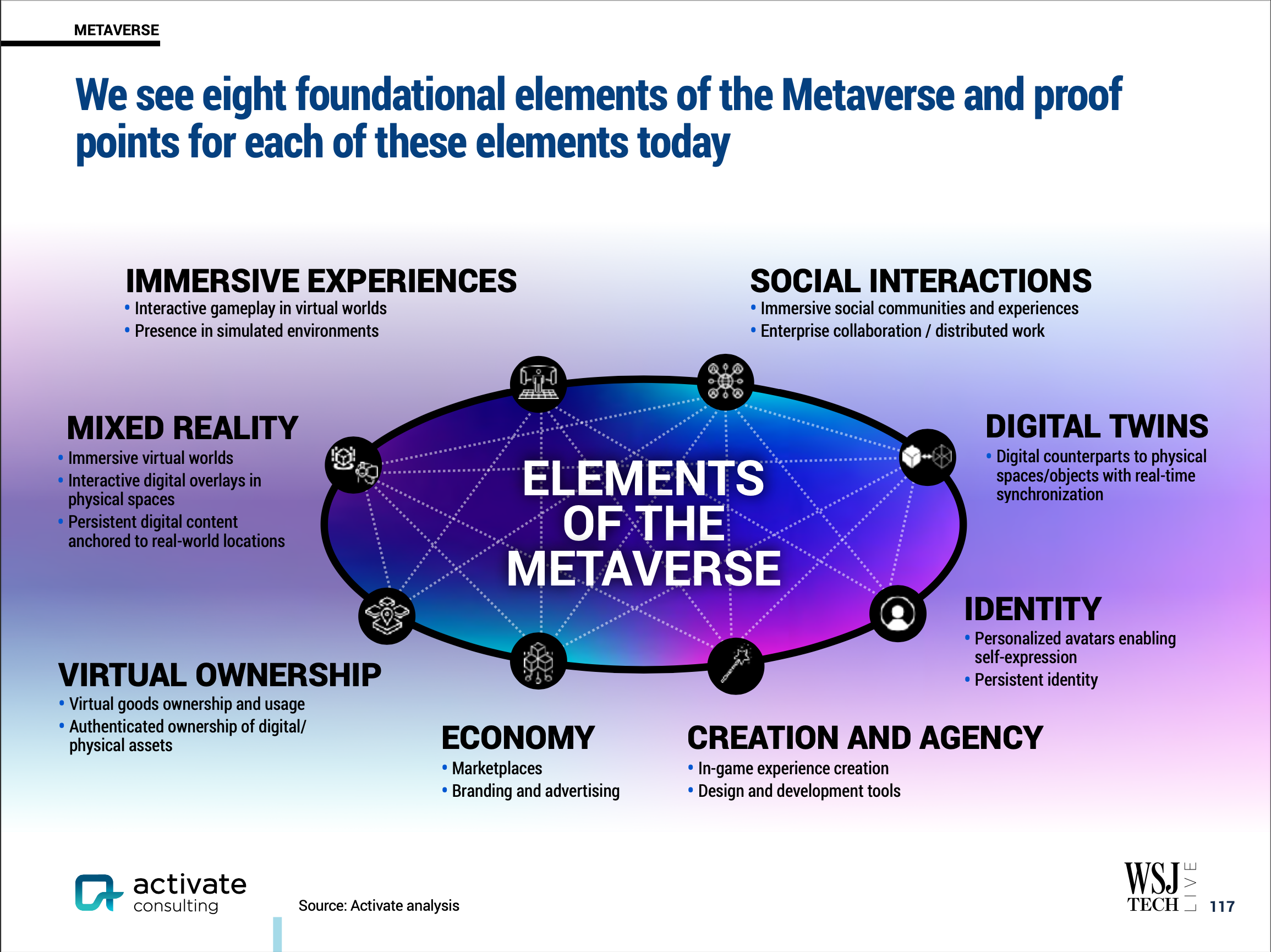

4. Metaverse

The report states that the Metaverse now needs companies to invest and sustain development in order to move the novel platform on to its next evolutionary cycle. There are plenty of examples of this platform already being a permanent part of our lives – in gaming and virtual worlds – that are providing cornerstones for the future.

Shared immersive experiences, social interactions, workplace collaborations and community building are all expected to flourish as part of the Metaverse platform.

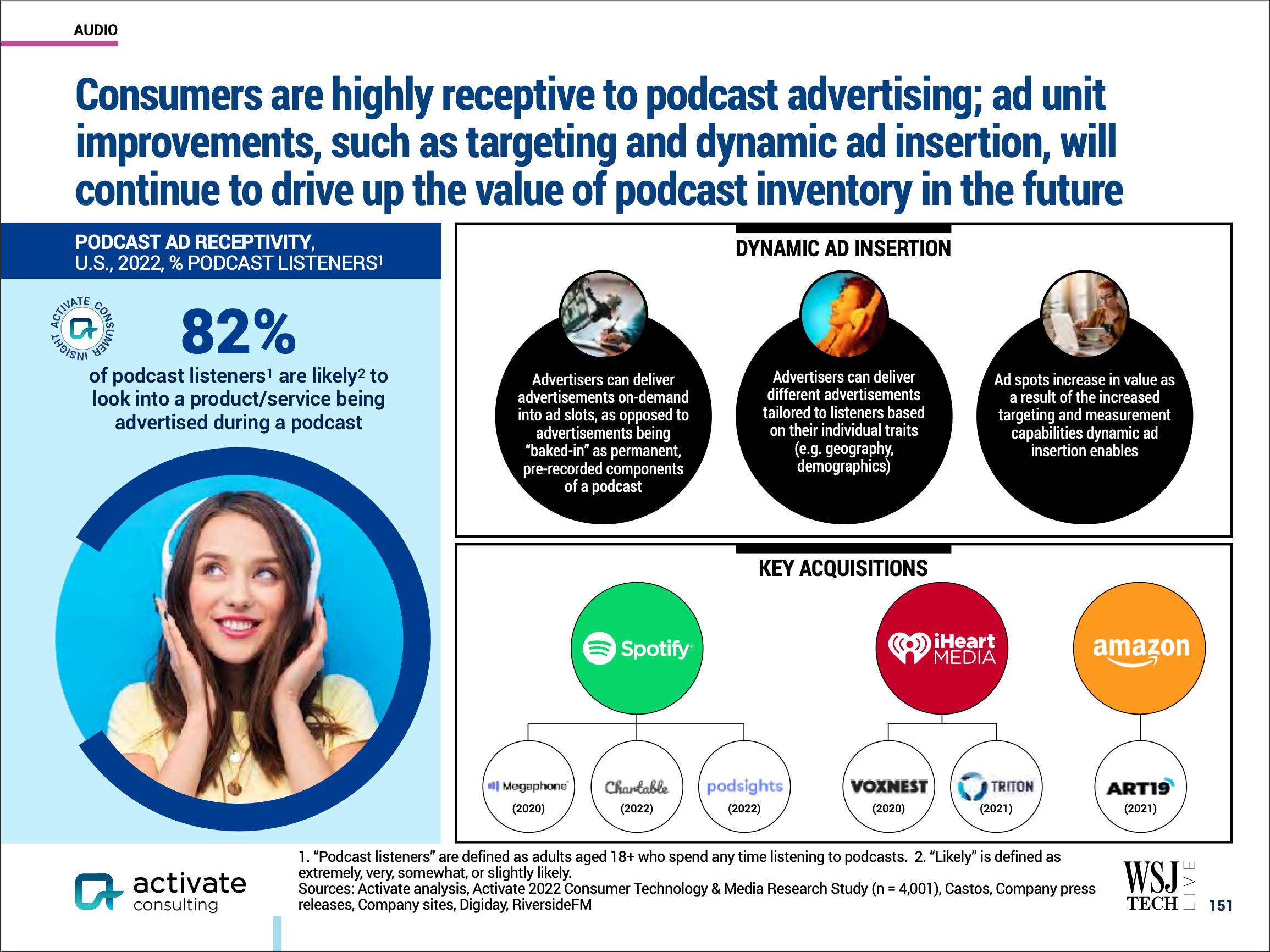

5. Digital audio

Audio is thriving, according to the Activate 2023 report, with 64% of music listeners using multiple free and paid services per month, including the most popular: YouTube. TikTok has evolved music listening, with users spending twice as much on music compared to non-users.

Podcasts will provide a significant area for future growth, as both music and podcast listeners use the same services to source content. There is plenty of space to consider advertising through podcasting as users seem to be more engaged.

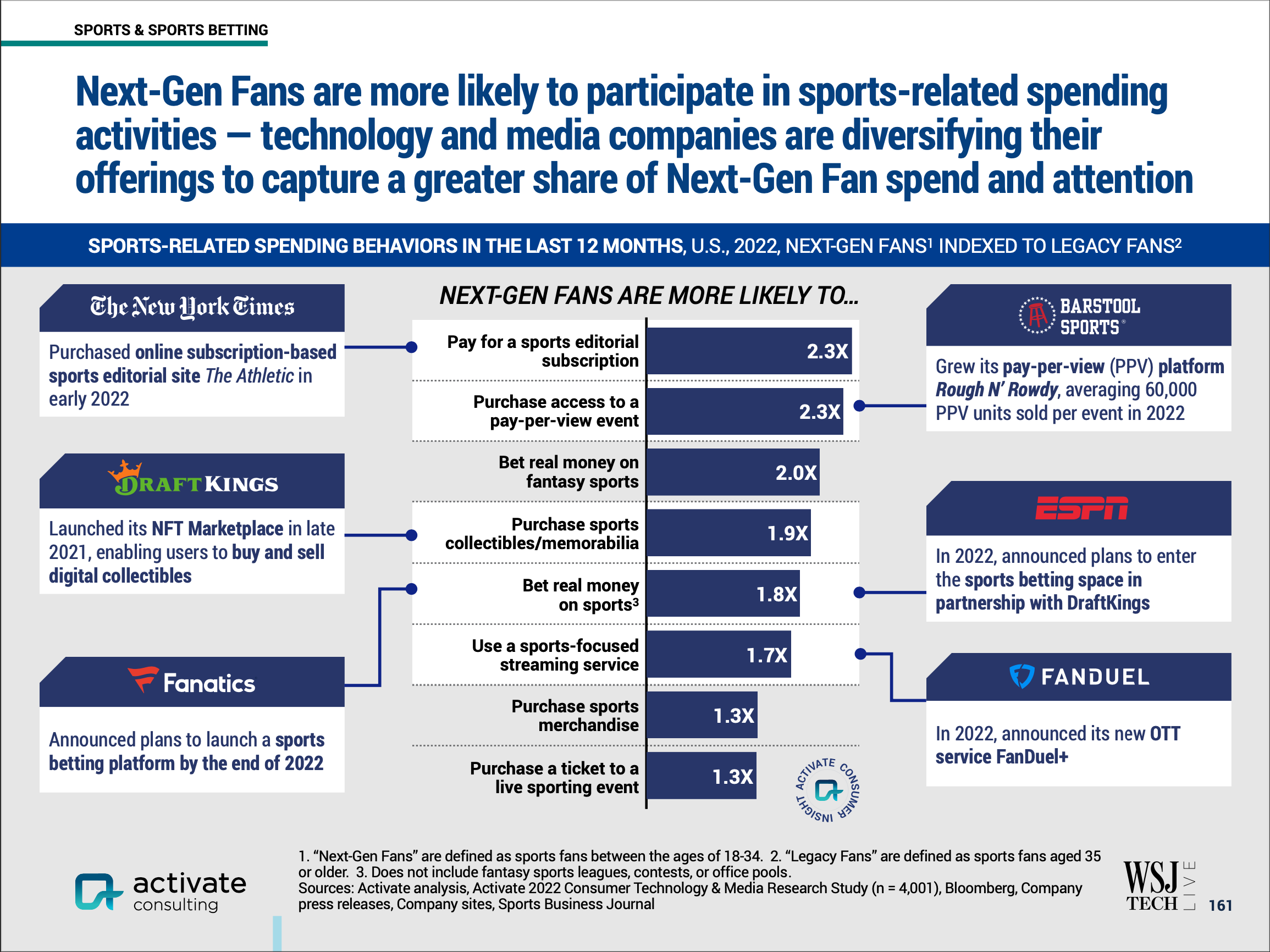

6. Sports and sports betting

A new type of audience has emerged: next gen sports fans, who are younger and are driving forward growth in live sports streaming and participation in sports-related activities. Next gen sports fans are also more likely to participate in sports betting and spend more money than older, legacy sports fans, with 17% of next gen fans taking part, compared to 10% of legacy fans.

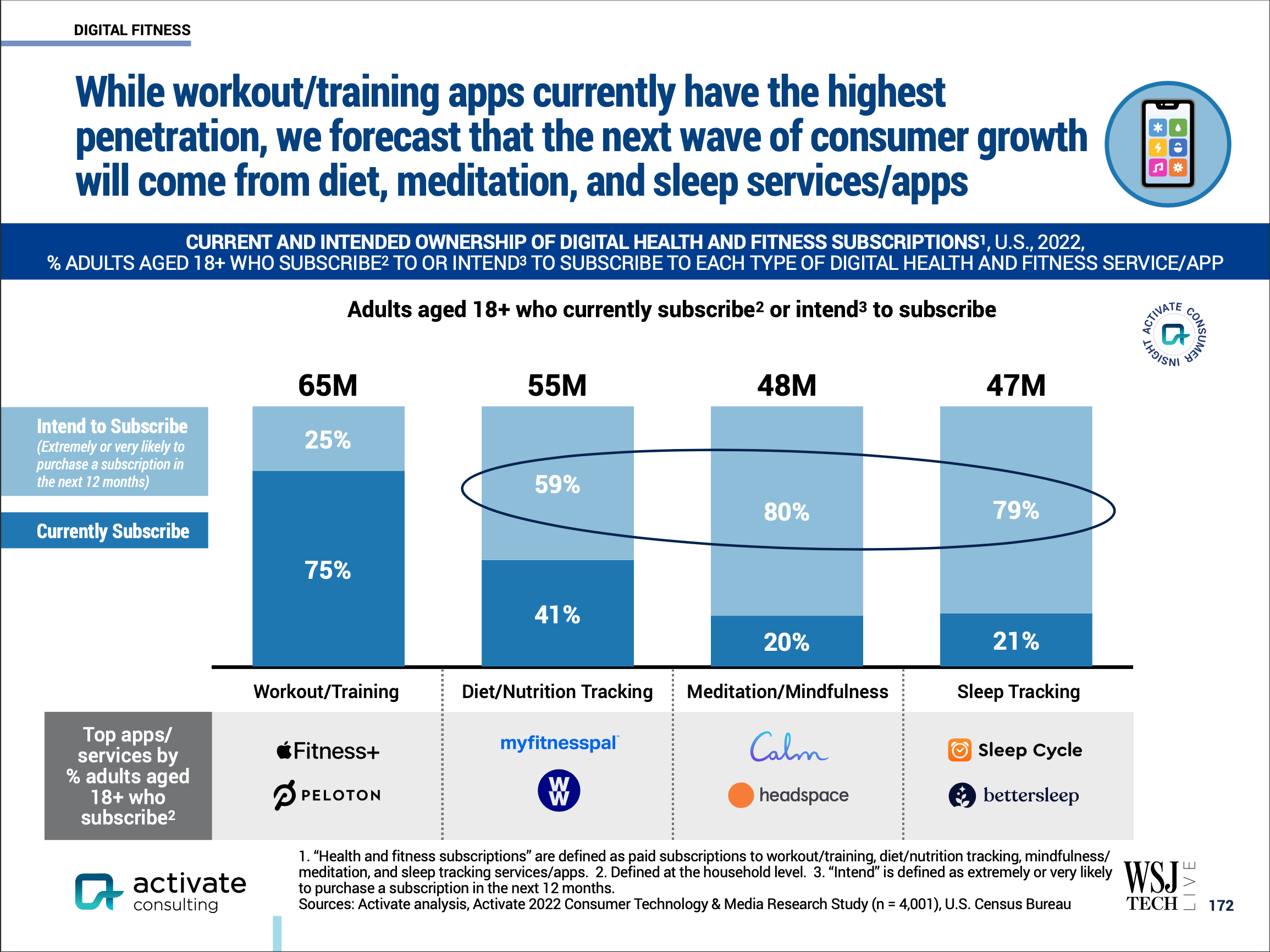

7. Digital fitness

There is substantial expansion predicted in the health and fitness technology market, as the report suggests a combined value of $30B by 2026. Digital fitness technologies have boomed since the pandemic; the most popular being wearables for tracking daily activity with 40% of US adults adopting these in 2022, compared to 24% in 2019.

Practical use cases are changing when it comes to digital fitness technology and services, with increasing engagement predicted for health and wellbeing apps.

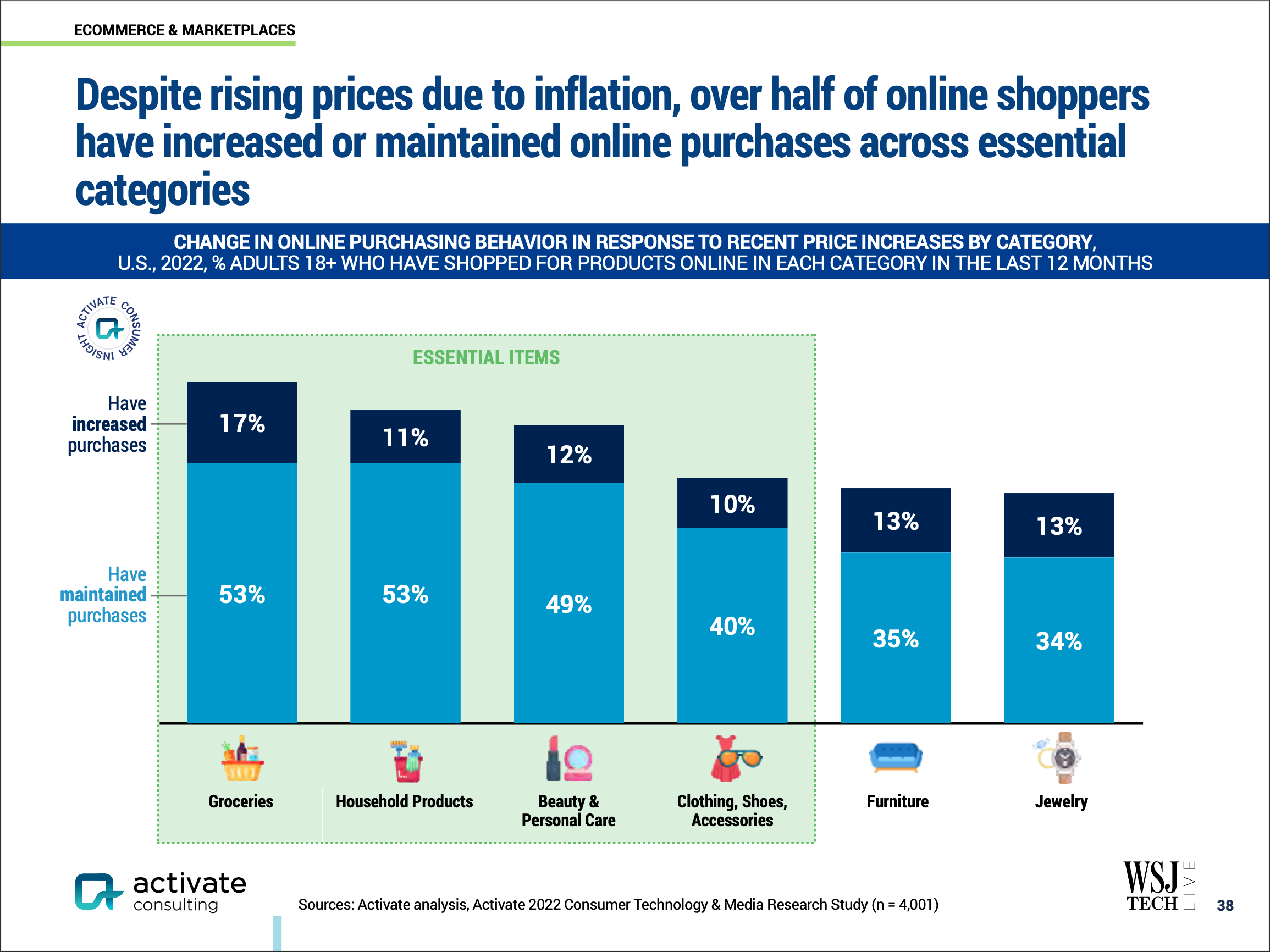

Ecommerce and marketplaces

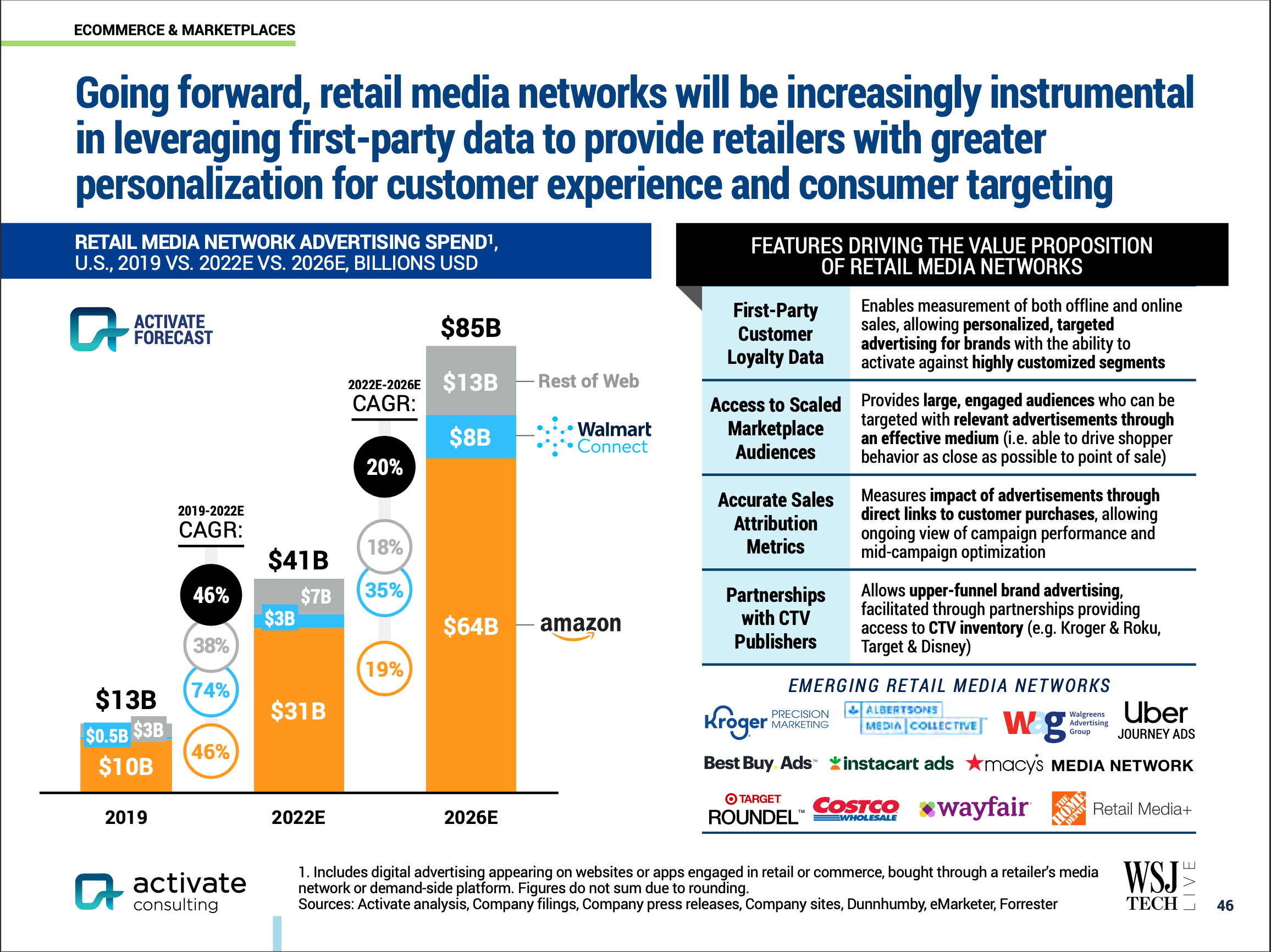

Global eCommerce is set to outdo physical retail in profit terms by 2026, even representing 20% of total US retail sales in 3 years’ time. Essential product categories will still dominate and drive eCommerce expansion, with price and product comparison sites becoming ever more essential to user decision-making.

It’s true to say that personalisation will continue to be a powerful component in eCommerce progression, with first-party data remaining vital in fuelling this practice.